Australian Payments Plus (AP+) is proud to announce that ConnectID, its digital identity solution, is now available, marking an important step in helping everyone in Australia to protect themselves from fraud and identity theft.

AP+ developed ConnectID to enable people to securely verify their identity to third parties without having to repeatedly share any unnecessary data about themselves. Instead of providing proof of identity documents, consumers can now ask a participating business to verify their information using organisations they already trust with their data, like their bank. ConnectID is now available to Commonwealth Bank (CBA) and National Australia Bank (NAB) customers on a number of use cases. It also has strong industry support with other strategic partners including Westpac and ANZ.

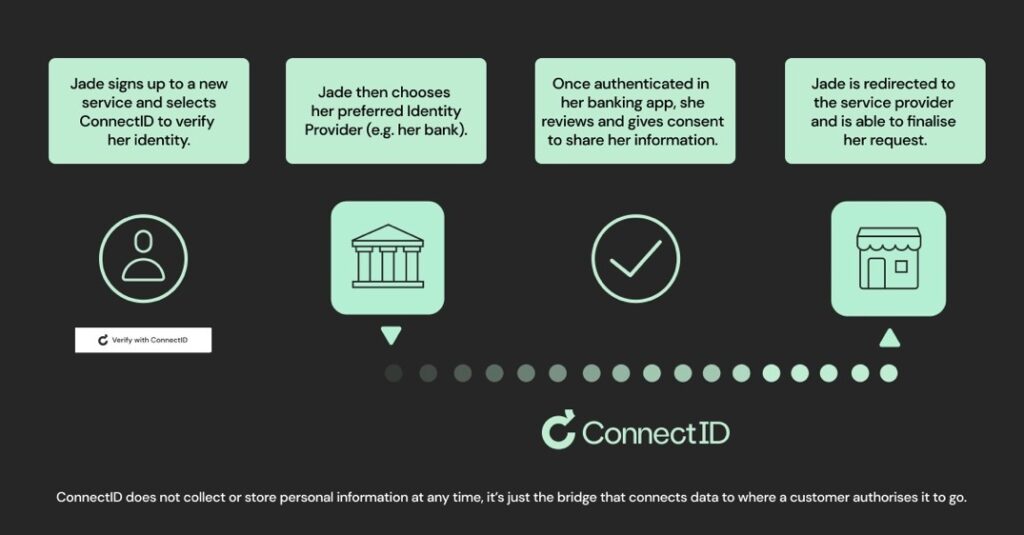

ConnectID doesn’t see or store personal information, it simply acts as a bridge between an organisation that wants to verify someone’s identity and the organisation providing that verification. This only happens when the customer authorises it. This means ConnectID combines the convenience of real time identity verification with enhanced security and consent.

With ConnectID, businesses can offer their customers a simple and secure verification process without the need to over collect and store customers’ personal information. Businesses across industry sectors will offer ConnectID as a means of safely verifying identity for their customers. These include: Referoo, Credenxia, ServiceSeeking, OnePassport, RentBetter, Shaype and more.

ConnectID Managing Director, Andrew Black explained, “This new service will help customers reduce oversharing their data, giving them greater control over what data is being shared and used and choice over which organisations they trust to store their personal information. And from a business perspective, the ability to collect only what is required means they’re able to comply with legislation and reduce their risk profile.”

“What’s important to know is that ConnectID is not creating new honeypots of data, in fact, we never see or store customer data. At every step of the way, ConnectID ensures both convenience and confidence, quickly and securely verifying customer identities,” Black continues.

CBA’s General Manager, Open Data, Katherine Sleeth said: “Commonwealth Bank is supportive of ConnectID which will simplify customer identification and authentication needs for both businesses and consumers across the economy. It will help keep consumers’ data safer online, with strong security and privacy controls.”

NAB Executive, Digital Governance, Brad Carr said: “We’re proud to support the launch of ConnectID today, which will make life so much easier for Australians when they are going through a process of validating their identity online, and doing so in a safe way that protects their data and privacy. “This represents a significant and exciting milestone in the journey towards enabling both NAB customers and the wider community to go about their digital lives more securely, whilst supporting growth and confidence in the Australian digital economy.”

Here’s how ConnectID verifies a customer’s identity without seeing or storing any data:

The Australian Federal Government released the National Strategy for Identity Resilience in June outlining how state and territory governments should make their digital ID systems more robust. In September 2021, ConnectID was the first non-government operator of a digital identity exchange to be accredited under the Australian Government’s Trusted Digital Identity Framework (TDIF) which sets standards, rules and guidelines based on international best practice.

Lynn Kraus, CEO of AP+ said, “At AP+ we see ConnectID playing an important role in building trust in our digital economy. We’re partnering with proven guardians of identity documentation such as the major banks to deliver simple and safe identity verification. We’re keen to see ConnectID play a role in an Australian digital identity framework that brings together both the government and non-government sectors in a world-leading solution to help protect people’s data.”