SYDNEY – 29 APRIL 2025 – (NYSE: FICO)

- 43% of Australians say scams that trick them into sending payments would cause the biggest financial loss

- Around 1 in 4 Gen Z and Millennial Australians (26%) are worried about real-time payment scams — compared to 1 in 6 adults nationally (17%)

- More than 1 in 3 Australians 18–34 believe their identity has already been misused

- Gen Z prioritise ease of use, and Millennials value cost savings, over fraud protection when choosing new accounts

Global analytics software leader FICO has released new consumer fraud research, highlighting growing concern among Australians regarding payment scams and identity theft – especially among younger generations.

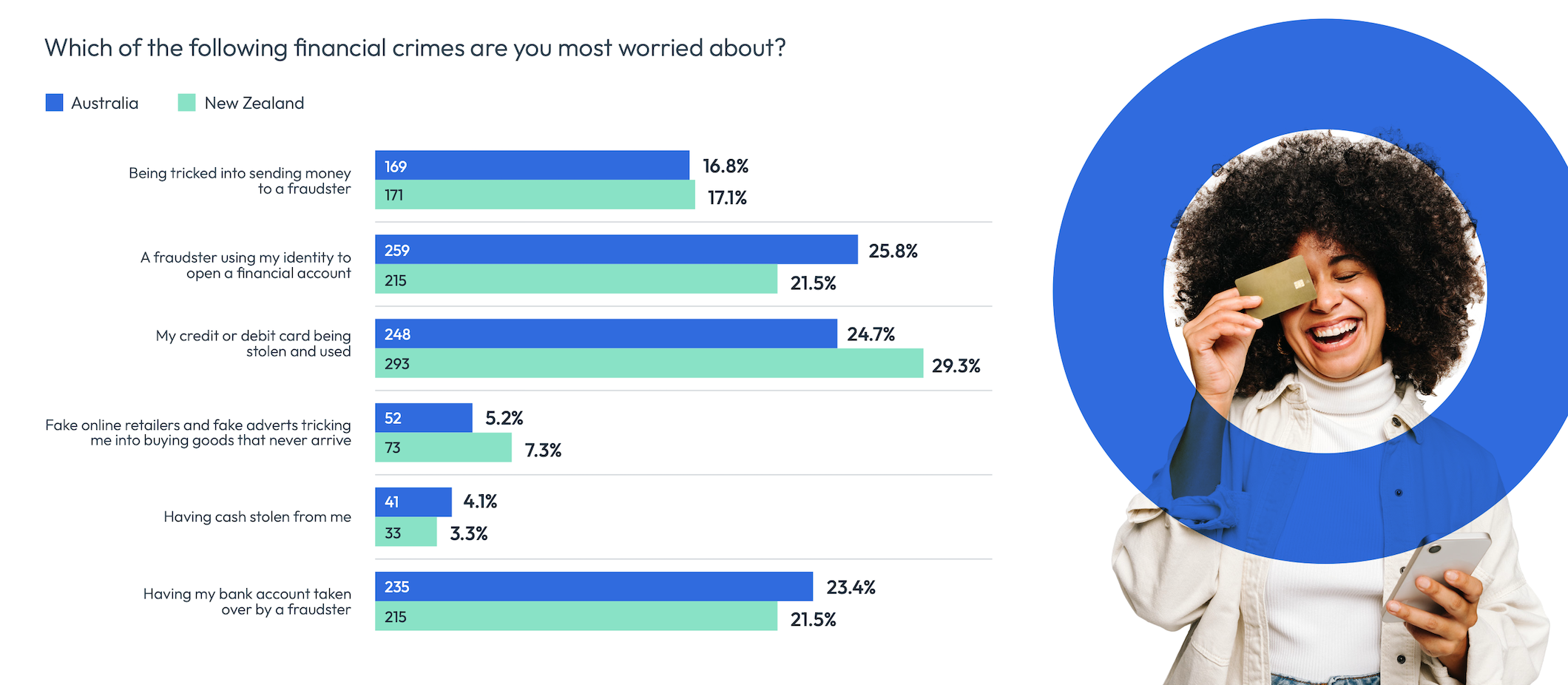

With real-time payments enabling instant, often irreversible transfers, 1 in 6 Australians (17%) worry about being tricked into sending money to fraudsters. That figure rises to 1 in 4 (26%) among Gen Z and Millennial consumers aged 18–34. When asked which scams they believe would result in the most financial loss, just over 43% of Australians pointed to deception-based payment fraud, far ahead of stolen cards (18%) and identity fraud (17%).

“Younger Australians are more exposed to digital risks simply because they live more of their lives online,” said Corey Smith, Senior Decisioning, Risk, and Analytics Expert at FICO. “They’re constantly using apps, marketplaces, and peer-to-peer payment tools, often moving money in real time. For many, even a small loss can hit hard — and they’re seeing scam stories go viral on social media every week. That mix of exposure, immediacy, and financial pressure makes scams feel very real for this generation.”

More information: https://www.fico.com/en/latest-thinking/ebook/consumer-survey-2024-digital-banking-customer-preferences-and-fraud-controls

Identity Theft Still Weighs Heavily on Young Adults

Australians continue to see identity theft as a major concern, with 26% citing it as their top financial crime fear. That rises to nearly 30% among 18–24-year-olds. Among Gen Z and Millennial Australians, 36% believe their identity has already been used fraudulently.

Yet despite these concerns, younger consumers don’t always prioritise security when choosing new financial accounts. Nearly half of Gen Z respondents (48%) ranked ease of use ahead of fraud protection (17%), while Millennials were more focused on cost: with 27% prioritising good value and 25% focussing on fraud protection.

“Security is critical, but financial institutions must ensure fraud prevention solutions are seamlessly integrated into user experiences to maintain customer trust and engagement,” added Smith. “By breaking down silos and integrating identity verification and fraud detection processes, we can streamline applications and bolster trust in legitimate customers.”

Security vs. Usability: Trust Doesn’t Always Translate to Action

Australians overwhelmingly believe in-branch account opening is the most secure option (75%), and that trust is reflected in their preferences for complex products like mortgages and personal loans. But when it comes to digital channels, behaviour and beliefs diverge. While 40% say mobile apps are more secure than websites (37%), more Australians still prefer to apply via a website than through an app for almost every product — including digitally native options like buy-now-pay-later. It suggests that while trust in apps may be growing, comfort and usability are still playing catch-up.

A similar contradiction appears in payment authentication. Australians are clear on what feels safest: biometric methods top the list, with 80% rating fingerprint and face scans as either “good” or “excellent” for security, and iris scans not far behind at 72%. Yet these aren’t always the most preferred methods when it comes time to make a payment.

Passcodes sent via SMS, while less secure in practice, remain the most popular authentication method for online card payments, with 81% of Australians saying they like or strongly prefer it. In comparison, passcodes sent to a bank’s app are trusted by 73%, but only 61% prefer using them. This gap between trust and adoption highlights a clear opportunity for banks: improve the user experience of secure options to ensure the most robust methods aren’t just trusted, but actually used.

FICO’s survey was conducted by an independent research company adhering to research industry standards. 1,004 Australian adults and 1,000 New Zealand adults were surveyed, concluding in August 2024. This was part of a project surveying approximately 14,000 consumers in 14 countries including: Canada, Brazil, Colombia, India, Mexico, Philippines, Spain, UK, USA, Malaysia, Thailand, Indonesia, and Singapore.

—END

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 80 countries do everything from protecting 4 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and has been made available in over 40 other countries, improving risk management, credit access and transparency.

Learn more at https://www.fico.com

Join the conversation at https://x.com/FICO_corp & https://www.fico.com/blogs/

For FICO news and media resources, visit https://www.fico.com/newsroom

FICO is a registered trademark of Fair Isaac Corporation in the US and other countries.